Content

Your Bench bookkeeper keeps your financial reports up-to-date, giving you access to essential and accurate information on your business’s financial health. Then, when tax season rolls around, a CPA or tax professional can use your Bench-generated financial reports to get your taxes filed—and advise you on which deduction to take. Tax software may charge more for itemized deductions.Your preferred tax software may upcharge you for helping you fill out Schedule A Form 1040.

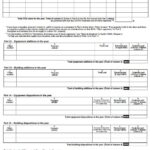

- Each section contains multiple subsections in which you can specify your deducted values.

- You can also use this deduction if you got a mortgage to buy out an ex’s half of the property in a divorce.

- And for homeowners who have a mortgage, there are additional deductions they can include.

- Make sure you factor in the extra cost for tax preparation when deciding which method saves you the most money.

- People with disabilities who couldn’t seek employment opportunities will benefit from these deductions.

- The Internal Revenue Service offers every taxpayer the option to itemize their deductions or to claim the standard deduction.

Read our guide to learn about cash-out refinance tax implications and possible complications. Make sure you factor in the extra cost for tax preparation when deciding which method saves you the most money. If you used part of mortgage proceeds Schedule A Form Itemized Deductions Guide to pay debt, invest in a business or for something else unrelated to buying a house. If the home was a timeshare, you can treat it as a home or second home and deduct mortgage interest as long as it meets the standard requirements.

Rocket Mortgage

Contributions carried forward from prior year may be deducted if your contributions were capped in a prior year. Iowa follows the federal guidelines for carryforwards, but certain adjustments to your contribution carryforward may be required as described below. Documentation of the carryforward amount may be requested by the Department.

How do you write an itemized deduction?

Itemizing requirements

In order to claim itemized deductions, you must file your income taxes using Form 1040 and list your itemized deductions on Schedule A: Enter your expenses on the appropriate lines of Schedule A. Add them up. Copy the total amount to the second page of your Form 1040.

Tina’s work has appeared in a variety of local and national media outlets. Once you’ve completed and signed your tax return, you can file Form 1040 electronically or print and mail it to the address shown in the Form 1040 Instructions. The Form 1040 Instructions include tables for help with the calculations, but tax software can handle https://kelleysbookkeeping.com/ that for you. Before getting started, gather all your tax documents, including your W-2s, 1099s and other records of your income and deductions. If you are having trouble accessing a form, try these potential solutions. The hundreds listed by the IRS, which is why working with a CPA or a good tax software is strongly recommended.

What if I’m missing a receipt? Should I still enter my deduction?

The actual fee Malia paid to register the automobile at the courthouse was $150. More specifically, only model year 2010 and newer trucks that weigh in at 10,000 pounds or less when empty are registered based on weight, list price, and model year. All other trucks are still subject to a registration fee based on weight. Consequently, certain 2011 model year and newer trucks may use the Vehicle Registration Deduction Worksheet. When you use TurboTax, we’ll ask simple questions about your deductions and fill out the Schedule A for you.