While stock trades are commission-free, Wealthsimple charges a 1.5% fee for converting CAD to USD, and vice-versa. This means that buying and selling U.S. stocks will come with a 3% round trip fee. Since the Forex market is decentralized, it are often far more susceptible to scams and fraudulent sites than other actions. It’s therefore essential to choose a legal forex broker which is regulated by a minimum of one financial authority. This may make sure that the broker is legitimate which your funds are in good hands. The foremost common regulations given to forex brokers Canada include CySEC, FCA, and ASIC.

USD/CAD Resumes Uptrend as Canadian Economy Slows – FX Leaders

USD/CAD Resumes Uptrend as Canadian Economy Slows.

Posted: Tue, 28 Feb 2023 08:00:00 GMT [source]

This kind of trading platform is specially built by the broker. Proprietary trading platforms have special features that are not common to MT4 or MT5 platforms. The conditions of trading on a proprietary trading platform can also differ from what obtains on MT4 or MT5.

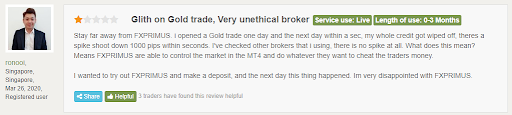

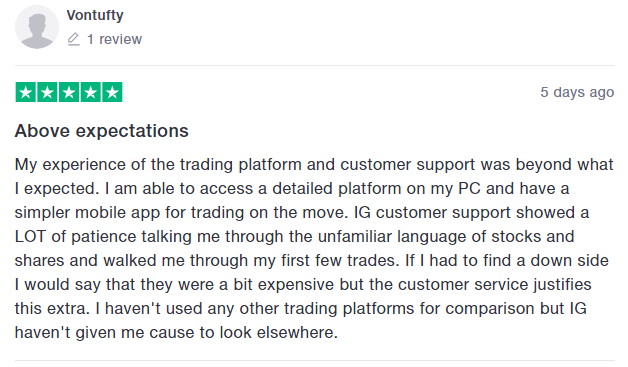

Quality of customer service

You can deposit using a credit card, debit card, or with a bank wire transfer. Withdrawals can also be made back to your credit or debit card, up to the amount initially deposited. Any excess amounts will need to be withdrawn via wire transfer. CMC Markets, regulated by the IIROC, is a CFD and forex broker that offers over 5,000 Canadian and U.S. stock CFDs, treasuries, commodities, and indices. You can also trade over 9,400 global shares from 23 countries, along with 1,000 ETFs.

Another feature that Questrade offers, besides its large selection of paid market data packages, is the ability to get unlimited snap quotes. This is free real-time data for certain Canadian and American markets, including TSX, NYSE, and NASDAQ level 1 data, that is available with just one click. It is simple to determine which Forex brokers in Canada are IIROC-regulated. You may do so by navigating to the bottom of the Forex broker’s webpage to discover trading in Canada and their licensing credentials. This information is accessible on several Canadian Forex brokers’ websites under the “About Us” section. Forex trading can be deemed a risky activity if one uses a high leverage.

Can we trade anything other than currencies with a Forex Brokers Canada?

You should also find out if the regulation is by a tier-1 regulatory agency. When choosing a broker in Canada, look for one that is regulated by the Investment Information Regulatory Organization of Canada (IIROC). Such a broker will not be fraudulent and your money will always be safe there.

USDCAD Falls As the Canadian Dollar Rose Despite Upbeat NFP – AskTraders

USDCAD Falls As the Canadian Dollar Rose Despite Upbeat NFP.

Posted: Fri, 05 May 2023 07:00:00 GMT [source]

FOREX.com, part of GAIN Capital, is a forex broker regulated by the IIROC in Canada. FOREX.com offers 3,000 stocks, 1,000 stock CFDs, 80 forex currency pairs, and a wide variety of indices and commodities. One feature that Canadian forex brokers offer that bank brokerages do not is the ability to make credit card deposits and withdrawals. Using a credit card to deposit gives you instant access to your funds to trade with, compared to having to wait days with a bank transfer, online bill payment, or wire transfer. However, some credit cards may charge a cash advance fee for such deposits. Interactive Brokers allow you to trade more than 100 currency pairs at very tight spreads (as low as 1/10 PIP, or 0.0001).

Currency Trading – What is a Forex CFD?

If a trade goes against you, you could lose more money than you initially invested, which can be a devastating blow to your trading account. Another advantage of using leverage is that it can provide greater flexibility in your trading strategy. With more buying power, you have https://forex-reviews.org/ more options for how you allocate your capital. For example, you could take a larger position in a single stock, or you could diversify your portfolio by taking smaller positions in multiple stocks. The biggest advantage of using leverage is the potential for increased profits.

Traders holding this type of account can access a minimum of one standard lot size. 1 pip of a forex pair with its base on the U.S dollars is the same as $10. Islamic accounts, or swap-free accounts, are an optional trading account type that allows forex traders to be compliant with the principles of shariah. This account type follows the Islamic Shariah principle and doesn’t charge interest for overnight positions. Managed forex accounts are high-reward and very high-risk investments.

What is their minimum deposit amount?

The regulatory agencies will help to determine if the Forex broker has a good protection strategy. The strategy will help to protect the accounts of traders in case things go south. Fluctuation in the values of currencies can negatively affect companies that do their businesses in foreign countries. This effect comes up when the companies buy or sell their goods and services outside their domestic markets.

- If you are a newbie in Forex trading, you may find yourself asking questions about the best currency pair to trade.

- A spread of 1.60% makes RBC’s currency conversion fee similar to Wealthsimple, but higher than Interactive Brokers’ spread of just 0.2 basis points.

- EToro, for instance , doesn’t charge a deposit fee, but withdrawals are subject to a $ 5 fee.

- The market is very huge and its daily turnover is up to US$5 trillion.

- These are accounts loaded with virtual money and don’t expose a trader to any risk.

Oanda offers a decent range of CFD trading options, of which 70 are foreign exchange pairs. Spreads on forex trading are as low as 1 pip (in this case, for EUR/USD). Keep in mind that this spread is ten times higher than the lowest spread offered by Interactive Brokers. Trade over 60 pairs of currencies as well as CFDs on crypto-currencies, shares, indices and …

$0 Commission on US & Canadian Shares

The high trading volumes of each of the currencies make them highly volatile and also help to reduce the spread. The number of traders that are trading a particular currency pair at a particular time can determine the behavior of the currency pair. There are so many currency pairs available in the Forex market. The currency pairs you can access depend on what your broker offers. This is to say that different Forex Brokers Canada offer different numbers of currency pairs. The US dollar is the most commonly traded currency in the world today.

- Forex is an abbreviation of foreign exchange and involves trading different international currencies by exchanging one for the other.

- The currency pairs have the highest level of liquidity also.

- This allows ECN Forex brokers to have narrower spreads than traditional brokerages, although it should be noted that several do still charge commissions on executed trades.

- Investor sentiment is fickle, and it is often tied to the aforementioned major world events.

- In most cases, traders will rely purely on technical analysis to try and predict which way a currency pair will move.